What Is A Good Credit Score In Australia?

A Guide For What Is A Good Credit Score

For credit scores ranging from 300 to 850, a score of 600 or higher is typically regarded as good, while a score of 800 or above is considered excellent. Most consumers’ credit scores fall between 600 and 750.

In Australia’s financial landscape, your credit score is more than just a figure—it’s a vital measure of your financial wellbeing and plays a key role in determining your eligibility for loans, credit cards, and other financial products.

You might be wondering:

- What is considered a good credit score in Australia?

- How can you check your credit score?

- What’s the average credit score across the country?

Why Is a Good Credit Score Important?

You may also question why having a good credit score matters. When applying for loans or credit cards, you’re likely to encounter credit checks as part of the process. Here’s why understanding and maintaining a good credit score is essential.

The last of these criteria is to ‘have a good credit rating’.

The Importance of Having a Good Credit Rating

The final piece of the puzzle when applying for loans or credit cards is to have a good credit rating.

Understanding Your Credit Score

In Australia, your credit score is a numerical summary of your creditworthiness, calculated based on factors such as your credit history, existing debts, repayment habits, and other financial behaviors. Credit scores typically range from 0 to 1,200.

What is Considered a Good Credit Score in Australia?

A good credit score enhances your financial options, giving you access to favorable loan terms and lower interest rates. In Australia:

- A score above 600 is usually considered good.

- A score above 800 is deemed excellent.

Lenders view a good credit score as an indicator of low risk, making it easier to secure personal loans, car loans, and credit cards.

2024 Credit Score Ranges by Major Agencies in Australia

Here’s how credit scores are categorized across three leading credit bureaus:

| Equifax | Experian | illion |

|---|---|---|

| Excellent: 853-1,200 | Excellent: 800-1,000 | Excellent: 800-1,000 |

| Very Good: 735-852 | Very Good: 700-799 | Great: 700-799 |

| Good: 661-734 | Good: 625-699 | Good: 500-699 |

| Average: 460-660 | Fair: 550-624 | Room for Improvement: 300-499 |

| Poor: 0-459 | Below Average: 0-549 | Low Score: 1-299 |

The Average Credit Score in Australia

The average credit score in Australia generally falls within the “good” range of 600–700. This serves as a benchmark for Australians to assess their financial health and highlights the importance of maintaining a strong credit profile.

How to Check Your Credit Score in Australia

Knowing your credit score is the first step to improving it. Australians can check their credit score for free through:

- Equifax, Experian, and illion, which provide annual credit reports.

- Various online platforms that offer free, instant credit score checks.

These tools make it simple to monitor and manage your financial standing.

Why Does a Good Credit Score Matter?

While credit score ranges are a useful guide, lenders ultimately decide what constitutes a “good” score. For example:

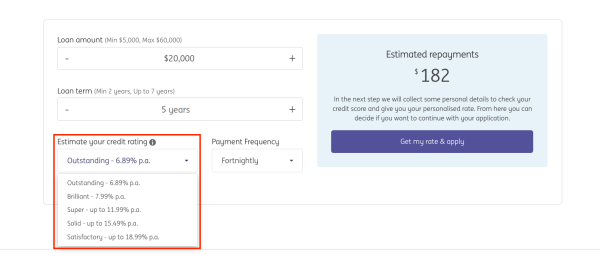

At ING, the interest rate on a loan varies significantly based on your credit score:

- Excellent score: Interest rate of 6.89% p.a.

- Good or Average score: Interest rate of 11.99% p.a.

- Satisfactory or Poor score: Interest rate of 18.99% p.a.

As you can see, your credit score can have a dramatic impact on your borrowing costs. A strong credit profile not only improves your chances of approval but also saves you money in the long run.

The takeaway here is, that it can pay to get quotes from MULTIPLE lenders based on your credit score.

The difference between them based on very slight credit score changes can be massive.

Improving Your Australian Credit Score

Improving your credit score is a journey that requires patience and discipline. Here are some strategies to enhance your score:

- Make Payments on Time: Late payments can negatively affect your score. Setting up reminders or direct debits can help ensure you always pay on time.

- Reduce Your Credit Card Balances: High credit card balances can lower your score. Aim to keep your credit utilisation ratio low.

- Limit New Credit Applications: Each credit application can result in a hard inquiry, which can slightly reduce your score. Apply for new credit sparingly.

- Regularly Review Your Credit Report: Check your report for errors or fraudulent activities that could hurt your score.

If you find inaccuracies, report them immediately to one of Australia’s credit bureaus: Experian, Equifax, or Illion.

Understanding Different Credit Score Tiers

Credit score categories can differ slightly in terminology across various platforms, yet they universally encompass five distinct levels:

- Outstanding: An outstanding credit score is a testament to a robust credit history. It signals to creditors that you’re a prime candidate for borrowing, likely qualifying you for the most competitive interest rates and attractive loan conditions.

- Very Good: With a very good credit rating, you demonstrate a strong ability to meet financial commitments, positioning you well for securing loans. While the terms might not be as advantageous as those reserved for outstanding scores, they’re still highly favourable.

- Moderate: A score in the moderate range might lead to somewhat elevated interest rates and more stringent conditions compared to higher tiers. Nevertheless, obtaining financial products remains a viable option for individuals within this bracket.

- Fair/Poor: Falling into the fair or poor score spectrum signals to financial institutions that past financial difficulties may have led to bankruptcies, defaults, or similar issues. This level of creditworthiness often results in either outright denial from conventional lenders or the imposition of significantly higher borrowing costs.

Average Credit Scores By Age

AGEAVERAGE AGEAVERAGE EQUIFAX18-2421.6626.8825-3429.8631.7435-4439.32630.9545-5449.05622.4455-6458.15673.1865+70.24756.35

Average Credit Scores By Gender

GENDERAVERAGE AGEAVERAGE EQUIFAXFemale40.1626Male39.17641.24

Average Credit Scores By Australian States & Territories

STATEAVERAGE AGEAVERAGE EQUIFAXNSW38.81680.66QLD40.44576.21VIC40.24605.88WA40.59565.7SA39.43622.71ACT39.6582.58TAS42.71586.26NT39.35578.3AVG FOR All STATES39.55610.46

Your Credit Score, Your Financial Future

Your credit score is a vital component of your financial identity in Australia. Understanding what a good credit score is, how to check it, and ways to improve it are essential steps in securing your financial future.

Leveraging Your Credit Score for Better Financial Health

A strong credit rating does more than just facilitate loan approvals; it’s a reflection of your financial discipline and reliability. By leveraging your good credit score, you can negotiate better interest rates, secure higher credit limits, and enjoy more flexible loan terms. This, in turn, can lead to significant savings and a more comfortable financial position over time.

Proactive Measures for an Excellent Credit Rating

To maintain or achieve a stellar credit rating in Australia, consider adopting a proactive approach towards your finances:

- Diversify Your Credit: A mix of credit types, such as a car loan, a credit card, and a personal loan, can positively affect your credit score, provided they are all managed responsibly.

- Stay Below Credit Limits: Regularly using a high percentage of your available credit can signal financial stress. Which can negatively impact your score.

- Keep Old Accounts Open: The length of your credit history contributes to your credit score. Keeping older accounts open can help maintain a positive history.

- Regular Updates: Ensure your personal information is up-to-date with credit bureaus, as inaccuracies can lead to issues with your credit report.

The Path to Financial Empowerment

Understanding and improving your credit score in Australia is a journey towards financial empowerment. It enables you to make more informed decisions, access better financial products, and ultimately achieve your financial goals with greater ease.

A Good Credit Rating Is…

A key piece of your financial puzzle in Australia. By understanding what a good credit score looks like, how to check and improve your score, and the impact it has on your financial opportunities, you’re better equipped to navigate the complexities of the financial world. Remember, a strong credit score is within reach with the right habits and strategies.

Start taking steps today to enhance your financial future tomorrow.

I hope you’re now better prepared to understand, manage, and improve your credit rating in Australia. Whether you’re checking your score for the first time or looking to improve an already good score, the journey towards financial health and empowerment starts with informed actions and consistent management of your credit.

FAQs

What Is a Good Credit Score in Australia?

As mentioned, a score above 600 is generally considered good, with higher scores indicating better “creditworthiness”.

What is a perfect credit score in Australia?

The maximum attainable credit score ranges between 1,000 and 1,200. Achieving the pinnacle of credit scoring, often regarded as the ‘perfect’ score, remains a rarity among consumers.

Nonetheless, striving to increase your score can make a big difference when applying for your next loan or credit card.

What can affect my Credit Score?

To improve your credit rating (positive actions):

- Always pay your debts on time, consistently.

- Keep up with bill payments without delays.

- Maintain a credit limit that exceeds what you owe.

- Clear your debts and credit card balances.

To lower your credit rating (negative actions):

- Missing loan payments or having them go into default.

- Applying for too many credit cards, loans, or other financial products in a short period.

- Being more than 60 days late on paying bills that are over $150, like for utilities or internet services.

- Having legal judgments against you related to financial issues.

- Experiencing bankruptcies in the past five years or recently coming out of bankruptcy.

How to Check Credit Scores in Australia?

You can get your credit score for free through comprehensive credit reporting bureaus like Equifax, Experian, and illion, or via online platforms that offer instant credit rating checks.

Still looking for a loan?

Smartloans can match you with the best loans for using your circumstances, without impacting your credit score. Chat with our team about how you can improve your credit score so you never have to stress about getting the finances you need.