Self-Managed Super Fund (SMSF) Lending: A Unique Investment Option

SMSF lending is a specialised type of loan that allows Australians to invest their superannuation in residential or commercial property. However, these loans come with a high level of complexity, requiring expert advice and professional guidance to ensure the proper structure and strategy are in place. It’s essential to understand the associated fees, charges, and legal compliance requirements to navigate this financial landscape effectively.

Key Features of SMSF Loans

- Loan-to-Value Ratio (LVR): SMSF loans typically cover up to 70%, and sometimes up to 80%, of the property purchase price. Loans exceeding this amount are not permitted.

- Residual Cash Requirements: Your SMSF must retain at least 10% of the loan’s value as cash reserves to cover unforeseen expenses.

- Repayment Source: Loan repayments and associated costs are made directly from your superannuation fund—not from your personal income.

Important Rules for SMSF Property Investments

- No Major Renovations: SMSF funds cannot be used for significant construction or renovations, as regulators aim to prevent super funds from being over-leveraged in construction projects.

- Owner-Occupancy Restrictions: You are prohibited from living in the property, even after retirement.

Complexities of SMSF Loans

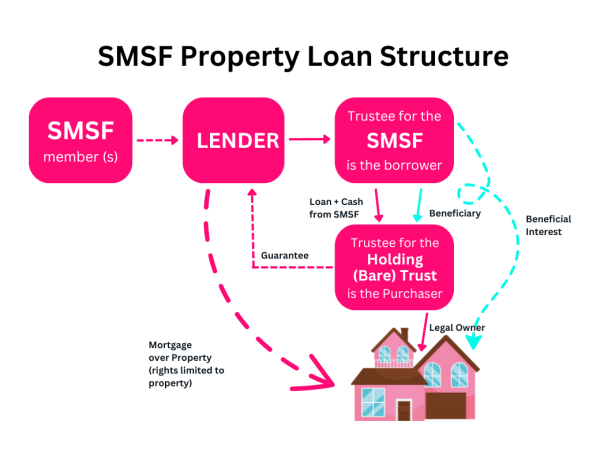

Numerous entities and processes are involved in structuring an SMSF loan. This detailed diagram highlights the interconnected roles of various entities, further emphasising the need for professional advice to manage this intricate investment strategy effectively.

It is important to know that your self-managed super fund actually can’t borrow money, but a Bare or Custodian Trust can. The Bare Trust is the missing link between you and the SMSF. When you have paid off the loan the trustee company will transfer the asset into the SMSF.

Your Super is a big part of your future financial stability! It’s complicated, so always seek the best advice, ask many questions, research, and think long-term. Whilst it is a very popular loan structure it is not necessarily suitable for everyone.

Generally, the absolute minimum amount you should have in super before you start considering this is $200,000. You will need to obtain a Statement of Advice from your financial professional.

Smartloans has a great team of finance professionals who can set this up for you so that you can make an informed decision. As mortgage brokers we simply facilitate the advice you have been given and from here we can find the most suitable SMSF loan for your personal situation.